Meeting Topic

Introduction to Meeting Topic:

10 Steps to Get the Best Lending Approval By Rachael Thompson

In this week’s meeting topic, Rachael Thompson shares her tips for getting the best lending approval. So, read the article and consider if you could use a bit of focused attention in any of the areas mentioned before YOU go for your next home loan or top up.

10 Steps to Get the Best Lending Approval By Rachael Thompson

Do your plans involve purchasing a home, renovations to an existing home or funding for changes in your business?

Here are my top tips to getting the best lending approval to fulfil your property dream.

MINIMISE DEBT – Short term Debt such as credit cards and personal loans can affect your ability to borrow to buy a home. Aim to repay any debt, but if that’s not possible, minimise it as much as possible to help your chances of getting a mortgage.

DEPOSIT – The higher your deposit, the lower your mortgage and therefore the cost of borrowing. Ideally you will have 20% of the purchase price, however many people are still buying first homes with less than 20%, but it costs you more to do this. An adviser can explain the differences.

BUDGET – Make a budget and stick to it. More money buys more space, but not more happiness. Ensure you don’t stretch your budget too far as you still want to have a comfortable lifestyle. Minimising your regular expenses can also assist with enabling you to get the mortgage you need.

RESEARCH / DATA – Learn the steps to buying a home before you get started. There are lots, and an adviser can help outline these for you. Data can help you make an informed decision. The ILG Mortgages team can run free reports on any properties you are interested in to assist with your decision.

THINK LOCAL – Find an agent that you connect with, who has extensive local experience and knows their market. Again, good data here can help.

TAKE YOUR TIME – Life circumstances often make people feel rushed to buy. Slow down and breathe, your perfect home may take time to find but you will find it.

CONSIDER RENOS – The Neighbourhood usually drives investment returns. If you can afford a lesser property in a more desirable neighbourhood, you may get a better return on your investment then purchasing your dream property in a less desirable neighbourhood.

PRIORITIZE / BE OPEN-MINDED – It is rare to get everything you want in one property. Think clearly about what matters most. Write your list but be willing to compromise along the way. You may buy something you didn’t expect to like. Viewing a property online can be very different to visiting it.

INSPECT – Make sure you know what you are getting into with a thorough home inspection. Take your friends, family and trade professionals to have a look. Opinions of others can make a difference, so it’s important to take your time when making such a large investment.

HAVE FUN – Buying a home should be exciting! If it is becoming a chore, it may be time to review some of the steps above and see if anything needs amending.

If you are ready to go shopping for your dream home or top up your mortgage to renovate or for business changes, check out how Rachael Thompson (the Smarter Mortgage Lady) helps her clients here: https://rachaelthompson.co.nz/

Print This Post

Print This PostNext Meeting Topic

Introduction to Meeting Topic:

Create New Opportunities to Thrive in Recession By Judy Celmins

In this week’s contribution, Judy Celmins shares research that can help us understand customer buying behaviour during a recession! Read the article and consider giving YOUR take on what your opportunities are in the current economic environment with your group.

As headlines shout doom & gloom, remember that primal human drivers don’t change, whatever the economic climate.

Understanding customers & consumption

There’s an excellent 2009 Harvard University study by Professor John Quelch and Research Associate Katherine E. Jozc on How to Market in a Downturn.

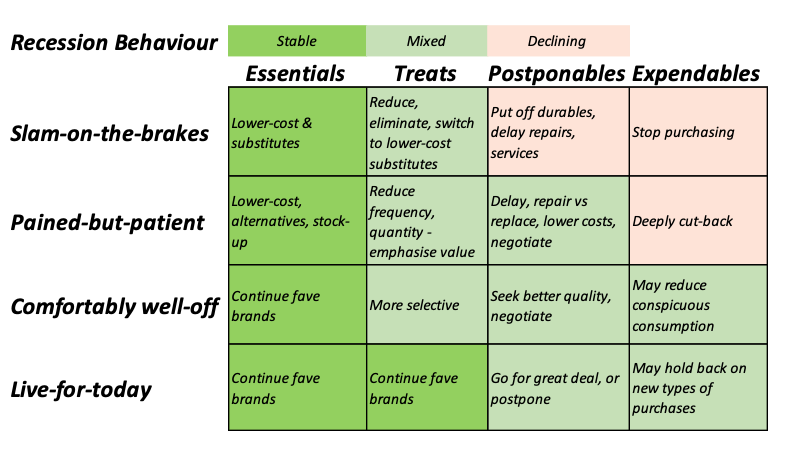

They identified four segments of customers in a recession …

- Slam-on-the-brakes: reduce all types of spending.

- Pained-but-patient: the largest segment, who economise, but not aggressively.

- Comfortably well-off: maintain spending, but more selectively and less conspicuously.

- Live-for-today: tending younger, who mostly extend their timetables for large purchases.

And also described four categories of products & services consumption …

- Essentials: central to survival or well-being.

- Treats: which customers view as justifiable.

- Postponables: can be put off.

- Expendables: unnecessary or unjustifiable.

So 16 possible combinations of customers and consumption to help plan your strategy.

This chart, derived from the article, shows 13 Recession Behaviour scenarios with potential opportunities, depending on your type of business and target customer.

The importance of Perceived Value

As incomes are squeezed and costs go up, people still have to function in life, and fulfil emotional needs as well as practical.

They will look for a way of gaining the same value from a lower cost alternative. And when it comes to Treats, it’s human nature to want even a small moment of pleasure, especially in tough times.

Potential tactics

The research suggests ways of adapting your offering to retain customers e.g. from the ‘Slam’ and ‘Pained’ segments

Essentials & Treats

- Offer smaller pack sizes for less money.

- Create a budget ‘substitute’ version.

- Promote ‘bonus’ packs to encourage stockpiling.

- Emphasise ‘dependability’ of your product or service.

- Promote Treats as a small ‘you deserve it’ indulgence.

- Reward loyal customers, even if they buy less (e.g. loyalty points, discounts, freebies).

- Promote Treats as affordable alternative to more expensive luxuries.

Postponables

- Challenge ‘false-economy’ behaviour with facts if the outcome is unsafe.

- Promote repair services, offer tips on how to extend the life of their purchase.

- Provide a simpler version.

Grow the relationship with advice & insights

Keep the customer relationship going, even when they’re not spending, to stay top-of-mind as conditions ease.

Maintain awareness and build trust with free advice on money-saving tips relating to your category. Even in an Expendable category, you could provide a temporary DIY alternative, with trust-equity repaid in future sales.

People turn to friends and community in difficult times – why not be a trusted friend in a recession? Use social media to stay in touch with customers and grow your relationship with practical content.

What’s the role of your product or service in their life? Have a chat with five of your top customers on what you can do to help them.

The Takeaway

Look for opportunities in primal needs. The only limit is your imagination.

I’m Judy Celmins, and I’m a marketing strategist with Thriveablebiz I can help you thrive, contact me judy@thriveablebiz.com

This is an extract from a more extensive article you can find here.