Meeting Topic

Introduction

Everyone sometimes struggles with differentiating a need from a want. The author of this introduction remembers the discussion about ‘what do we want’ vs ‘what do we need’ being a massive part of shifting her family (and life) from the US to NZ 14 years ago. In this article, member Sarah McMurray gives us a simple yet effective way to begin to learn the difference for ourselves so that we can improve our relationship with money. Consider sharing how you navigate this issue during your 60-second introduction in the next meeting.

Needs and Wants By Sarah McMurray

One of my favourite quick jokes in the Pixar movie “Inside Out’ is when they are on the Train of Thought and Joy knocks over crates of facts and opinions, then tries to tidy them up.

Joy: “Oh, no! These facts and opinions look so similar!”

Bing-Bong: “Ah, don’t worry about it. Happens all the time.” Puts an armful of everything into the crate labelled ‘facts.’

In my line of work, it is the needs and wants that can look so similar.

“Asking yourself, is this thing I’m about to buy a need, or a want” is really common ‘be good with money’ advice.

The first problem with this advice is that needs and wants aren’t always that easy to tell apart.

It doesn’t help that when we really want something, our brains can instantly produce at least 17 reasons why we need it.

And the opposite problem can also occur. Sometimes we can find it very hard to allow ourselves to either want something, or to allow ourselves to have the thing that we want. Especially after a sustained period of having to deny ourselves any wants at all, the idea of spending on something that isn’t absolutely necessary can feel less like freedom and more like the beginning of a free-fall.

When we’ve taken on the idea that (basic) needs can be (begrudgingly) fulfilled, but that all wants are a frivolous waste of money, we quickly get to the point where we’re living in deprivation.

We can all live like this for a while, especially if doing so allows us to achieve an important goal, or if we know it will end in a certain time frame. But living with constant deprivation can lead to acting out and overspending – a “Damn it, I’m worth it!” attempt at self-care.

What’s needed is a way to tell our true needs and wants apart. I’m yet to find a better way to do that than my favourite quote from Karen McCall:

A want, when met, entertains you.

A need, when met, sustains you.

Substituting wants for needs will eventually drain you.

When you identify the things that sustain you, that’s where your time, energy and money are best spent – on your deepest needs.

Over the next fortnight, take the time to notice the things you are denying yourself.

Instead of just dismissing the idea (“Far too expensive; can never do that; especially not right now!”) ask yourself how it would feel if you could have what you’re thinking of.

If the idea of getting a cleaner, or making a dental appointment, or having more than two work outfits, (or whatever it is) makes you feel happy, that’s probably a want.

If you get a deep sense of relaxation and relief at simply imagining having (whatever it is) – that’s a need. Figuring out how to meet that need (sometimes by spending little or no money) is a vital part of healthy behaviour with money.

To find out more about how Sarah helps her clients, check out her website: r2m.co.nz/about-sarah/

Next Meeting Topic

Introduction

By now, nearly everyone has become familiar with the term ‘AML’ or anti-money-laundering. Either your business has to report certain information about your new clients (you are a ‘reporting entity’) or you’ve been on the receiving end of AML identity verification. It’s all about managing risk in business, and the article below is meant to help us ALL understand the concept of risk regardless of whether we are considered a ‘reporting entity’ or not! Have a think about the potential financial risks in your business and what measures you’ve taken to manage those when you share your 1-minute intro next meeting.

Risk Management for Businesses by Dr Giulia Dondoli

Reporting entities in New Zealand must assess their money laundering risks, which means that they need to understand how their services can be exploited by money launderers, in the absence of any mitigation strategies. These risks are affected by several factors: the size and complexity of the reporting entity (big and complex organisations may have limited visibility on clients and transactions), the services offered (some services are more prone to favour anonymity than others), jurisdictional exposure, and so on. As an anti-money laundering consultant, I help my clients in assessing their money laundering risks and in developing adequate policies and procedures to mitigate such risks.

However, risk management principles apply to all aspects of business, and, whether consciously or unconsciously, we may often think about what we do in terms of risks. This post discusses how we can conceptualise risk and make informed decisions on risk management.

What is risk?

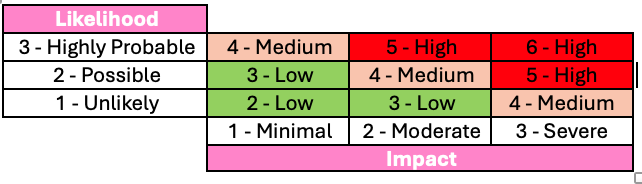

Risk is defined as the relationship between likelihood and impact. Likelihood is the possibility of a potential risk occurring. Impact is the expected harm or adverse effect due to exposure to such risk. With a simple likelihood-to-impact matrix, we can calculate a risk score by adding the value assigned to likelihood (from 1 to 3) to the value assigned to impact (also from 1 to 3).

For instance, the likelihood of spilling a drink in the kitchen can be rated as ‘Possible’, which we assigned a numerical value of 2. Meanwhile, the impact can be considered ‘Minimal’ since it only takes a few minutes to clean up, corresponding to a numerical value of 1. This results in a total risk score of 3, making drinking coffee a low-risk activity.

In our day-to-day lives, we may not need to use a risk matrix to assess risks. However, deconstructing risk between likelihood and impact can be a useful way to conceptualise risks when we need to make important decisions, like making an investment for our business, launching a new product or taking up a loan.

Once we have assessed risks, the next step is managing them.

Risk Management

We can use four key risk management strategies:

- Avoid – The best way to manage any risk is to avoid it. I consider skydiving an extremely high-risk activity, and I chose to avoid it. However, this is not always possible or advisable.

- Reduce – Our next best option is to reduce risk, by modifying our behaviour. I wear a seat belt while travelling in a car.

- Transfer – We can also transfer our risk to a different entity. I am concerned for my family in the case of an illness; therefore, I take a life insurance policy to transfer some of my risks.

- Tolerate – If we are not able (or willing) to do any of the above, the last remaining strategy is tolerating the risk.

These strategies do not exist in isolation, and they can be applied in combination with one another.

For more information on how Giulia supports her clients with anti-money laundering compliance, you can reach her at:

M: 021 0859 0042

Print This Post

Print This Post